The risks of investing

- Before you start investing, make sure you're using money that you don't need in the short term.

- It is a good idea to first create a financial buffer for unexpected expenses.

- Don’t bet on a single horse; instead, spread your investment over multiple companies and in multiple financial instruments.

- Think about the reasons that you want to invest and for how long. Make sure you adapt the risk you take accordingly.

How to reduce your risks

Step 1

Have the right time horizon

Before you start investing, make sure that you don’t need the money soon and decide whether you are prepared to take the risks involved. What are your investment goals and how important is it that you achieve them? Are the consequences big if you don’t succeed? In general, the more time you have, the greater the chance that the goal you have set will be achieved.

Step 2

Spread your investments

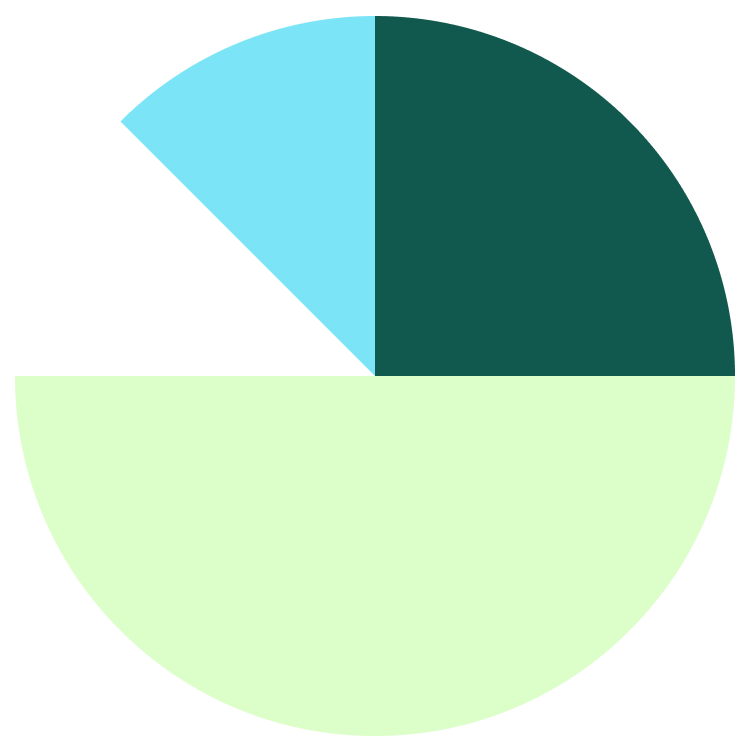

Spreading out your investments helps to mitigate concentration risk. This is the risk you take when you invest in, for example, a single equity or only in a certain sector. If things go badly with that equity or sector, this has a major impact on your portfolio.

You can diversify in different ways. For example, you can use different types of investments. There are four main ones: equities, bonds, alternative investments (e.g. commodoties, gold) and liquidities.

In addition, you can diversify by sector and region. By spreading your investments over different sectors and regions, you will be hit less hard when, for example, a macroeconomic problem exists in a region or when a certain sector is hit.

If you choose MeSolo, it is important that you build up a well-diversified portfolio yourself if you want to reduce the risk. When you choose MeManaged, you can easily decide for yourself how much risk you want to take. We will then ensure that your investment is effectively spread out.

Step 3

Work on your knowledge and experience

Step 4

Is it better to invest smaller amounts on a regular basis?

Markets fluctuate due to economic and political changes. This impacts the value of your investments. You might find it safer to invest a smaller amount on a regular basis instead of a larger sum all at once.

You are then less likely to put the entire sum into the market right before a downturn. From the point of view of returns, however, studies show that investing the entire lump sum produces better returns most of the time.

At the end, your choices come down to your personal preferences, character and financial situation.

Save or invest?

|me> deposit

I save with a high rate

- You receive 3.4% savings interest on an annual basis

- Your savings are fixed for three months

- Free account, with a minimum deposit of €100

- Deposit guarantee up to €100,000

|me> managed

I'll let experts invest for me

- Available from €100 deposit

- Selection of different risk profiles

- Your portfolio will be tailored by experts

- A well diversified portfolio using low-cost ETFs,

|me> managed

I'll let you do the work

- Experts manage your portfolio

- A selection of different risk profiles

- Available from €2,000 deposit

|me> save

I save with a high rate

- Free and unrestricted saving with high interest rates

- Deposit guarantee up to €100,000

You can't make a choice yet?

Do this short test and in a few steps you find out what investment services suits you best.